by Jorge Gomez • 4 min read

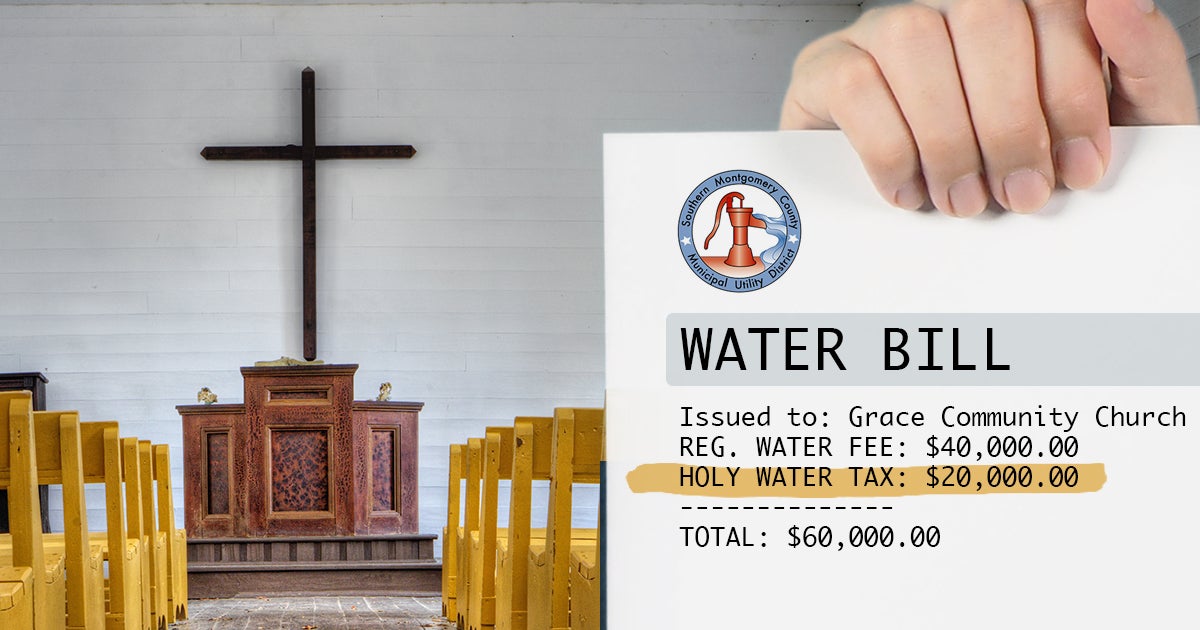

It’s illegal for local governments to tax churches and nonprofits. Shockingly, Montgomery County, Texas officials seem to have forgotten. They’re discriminating against our client, Grace Community Church, and trying to get them to pay an excessive “fee” for installing a water tap on their property.

We filed a lawsuit this week against the Southern Montgomery County Municipal Utility District (MUD). Our attorneys argue that it is discriminating against the church and violating the law. We explain that government officials are attempting to impose additional “fees” that exceed the actual cost of labor, equipment and materials to install the water tap. Our suit states:

“The tap fee imposed by the District on its face exceeds the cost of government action here—the installation of the tap. Indeed, one iteration of the tap fee was equivalent to fifteen years of taxes and the last iteration exceeds what Grace would pay in taxes over seven years if Grace were not a tax-exempt entity. Therefore, the tap fee constitutes an impermissible tax. The District and its Directors acted without legal or statutory authority in imposing this tax disguised as a tap fee, and Grace is entitled to a refund of the disputed amount.”

The district’s original quote said it would cost approximately $36,000 to install the tap. However, the church received a second invoice for nearly $62,000. Grace Community raised questions about the calculation of this second invoice, but the district sent an updated invoice for close to $148,000.

After the church went to discuss this six-figure fee at a board meeting, the district offered to reduce the fee. In September, the church paid the latest fee quoted by the District—$83,780—in order to have the tap installed. The church, however, made it clear that the payment was under protest and duress. Our lawsuit seeks to get that payment back and correct the issue that led to the fee-in-lieu-of-taxes bill from the utility district.

Earlier this year, we sent a letter to the district explaining that it’s so-called “fee” was simply a “tax” by a different name. It was nothing more than an underhanded attempt to wring more money out of a tax-exempt organization. We pointed out that the invoices and excessive charges sent to the church made “abundantly clear the MUD’s attempt to recoup taxes by simply recasting it as a ‘fee.’”

This is not the first time Texas officials have tried their hand at a “holy water tax” scheme. First Liberty won a similar case in state court on behalf of three Magnolia churches—Magnolia Bible Church, First Baptist Church and Believers Fellowship.

City officials created an expensive water rate “institutional fee”—essentially levying a “water tax”—that only applied to churches, faith-based schools and other nonprofit organizations. How much more did churches have to pay than commercial businesses? In one case, a church’s water bill increased by 178%!

After two years of fighting in court, First Liberty reached a settlement restoring religious liberty for our three clients. The City of Magnolia agreed to reclassify its water-rate structure and treat “all religious organizations, religious non-profits, churches, or houses of worship” equally with commercial businesses.

On top of being unlawful, these “fees” are simply bad policy and starkly unfair. Churches, faith-based institutions and nonprofits across America provide essential services, assistance, benefits and resources for people in need. That’s why they’re tax-exempt in the first place.

“Churches provide an immeasurable service to their communities,” explains Jeremy Dys, Senior Counsel at First Liberty. “Utility districts that impose an illegal fee-in-lieu-of-taxes scheme undermine the vital services churches provide their communities.”

Bottom line: Government officials should not punish and burden churches and ministries with extra fees that keep them from living out their faith, fulfilling their mission and caring for the most vulnerable in their communities. In the end, everyone—including the state—suffers the consequences.