by Jorge Gomez • 4 min read

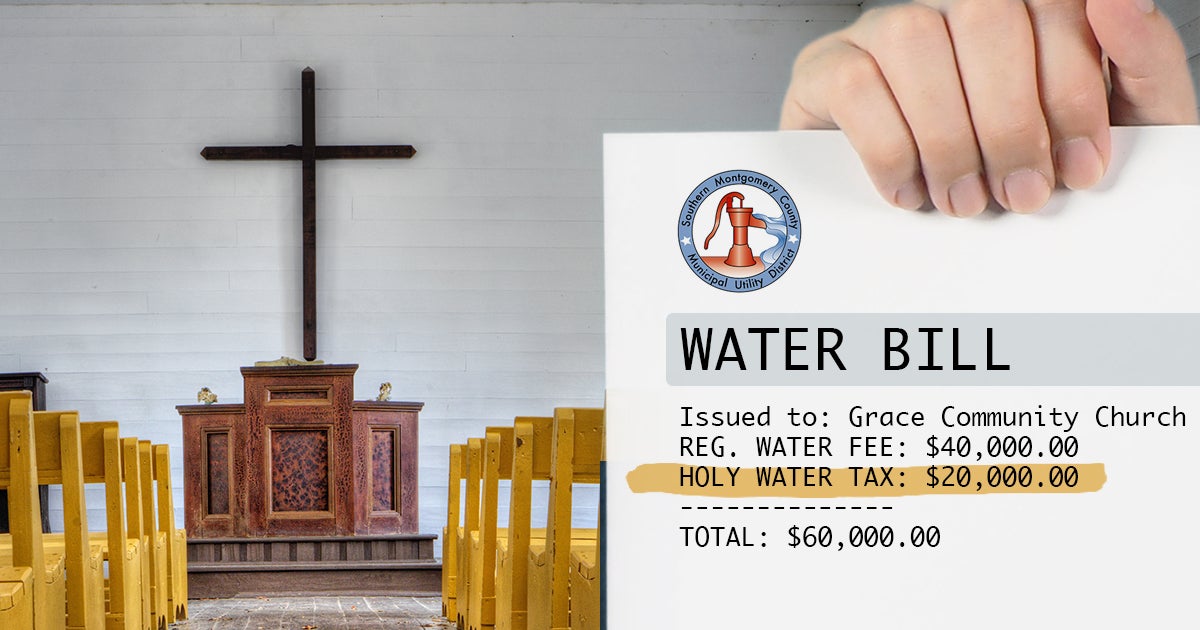

In Texas, it’s illegal for local governments to tax churches and nonprofits. Shockingly, Montgomery County officials seem to have forgotten that. They’re discriminating against our client, Grace Community Church, and trying to get them to pay an excessive “fee” for installing a water tap on their property.

First Liberty recently sent a letter to the Southern Montgomery County Municipal Utility District explaining that it is singling out the church. Their attempt to impose additional “fees” exceed the actual cost of labor, equipment and materials to install the water tap. We make clear why this violates the law:

“Any such additional fees amount to a tax, and because Grace is a non-taxable religious entity, such a tax is impermissible under Texas law…Grace objects to and refuses to pay any additional, unlawful tax.”

The district’s original quote said it would cost approximately $36,000 to install the tap. However, the church received a second invoice for nearly $62,000. Grace Community raised questions about the calculation of this second invoice, but the district sent an updated invoice for close to $148,000.

After the church went to discuss this six-figure fee at a board meeting, the district offered to reduce the fee back to $61,500. Even still, we argue that “because this revised fee still includes fees beyond the actual cost of installing the tap…it is still an impermissible tax on a religious, tax-exempt entity.” Our attorneys asked the district to provide Grace Community with an updated invoice reflecting the actual cost.

Our letter exposes this for what it really is: an underhanded scheme to wring more money out of tax-exempt organizations. We point out that the invoices and excessive charges sent to the church make “abundantly clear the MUD’s attempt to recoup taxes by simply recasting it as a ‘fee.’”

This is not the first time Texas government officials have tried their hand at a “holy water tax scheme.” First Liberty won a similar case in state court on behalf of three churches— Magnolia Bible Church, Magnolia’s First Baptist Church and Believers Fellowship.

City officials in Magnolia created an expensive water rate “institutional fee”—essentially levying a “water tax”—that only applied to churches, faith-based schools and other nonprofit organizations. How much more did churches have to pay than commercial businesses? In one case, a church’s water bill increased by 178%!

After two years of fighting in court, First Liberty reached a settlement restoring religious liberty for our three clients. The City of Magnolia agreed to reclassify its water-rate structure and treat “all religious organizations, religious non-profits, churches, or houses of worship” equally with commercial businesses.

On top of being unlawful, these “fees” are simply bad policy and starkly unfair. Churches, faith-based institutions and nonprofits across America provide essential services, assistance, benefits and resources for people in need. That’s why they’re tax-exempt in the first place.

Jeremy Dys, Senior Counsel at First Liberty, explains: “Churches provide an immeasurable service to their communities. Utility districts that impose an illegal fee-in-lieu-of-taxes scheme undermine the vital services churches provide their communities.”

Bottom line, government officials should not be punishing and burdening churches and ministries with extra fees that keep them from living out their faith, fulfilling their mission and caring for the most vulnerable in their communities. In the end, everyone—including the state—suffers the consequences.