by David K. Holmes • 3 minutes

I admit reading about trusts and estates, and wills, and charitable giving can be less than exciting. As a former Wall Street private investment banker, I have had many discussions about such topics with clients, and it’s not like talking baseball or your favorite steak place. However, people do enjoy philanthropy – it’s the trusts and wills parts that put people to sleep. Let’s see if I can at least keep you interested enough to keep reading!

For the past 12 years, I have been the chief operating and financial officer at First Liberty. Recently a senior board member asked me to describe what will be a significant challenge facing First Liberty in the years to come. For me, the question has always been, “Threats to religious liberty will still be around in the future, but will First Liberty have the resources then necessary to continue the fight?” So, the board has asked me to confront this issue head-on and to plan for the financial well-being of First Liberty.

As a “Wall Streeter”, I was trained to think a lot about “asset and liability mismatches.” The definition of this arcane phrase is simple, but its execution can be intricate. It is simply those situations where funding is not “timely and in sync” with the liabilities they must fund. For example, a life insurance company takes in premiums now, but it sets aside funds in portfolios that are “rolling investment ladders,” which mature each year forward, sufficient to meet projections of required policy payouts in the coming periods.

Here at FLI, we traditionally raise funds to pay our current liabilities, and thanks to your faithfulness, we are in a very sound financial condition. Those are your religious liberty insurance premiums, so to speak, that allow us to fight the good fight. However, we do not have endowments or long-dated asset vehicles set to fund our efforts in the out-years like those of an insurance company. Donors who contribute now want their donations to pay for current threats to religious liberty. That’s understandable. But we also must worry about what’s up ahead 20 or 30 years from now, say in the year 2050.

So, in the coming days and months, I will be writing about various ways supporters can help FLI meet its future liabilities. And what are those liabilities by the way? Some of our most challenging cases can last up to 10 years or more, especially those headed to the US Supreme Court. These cases require out-year funding separate from normal operating funds, and they need it when they need it!

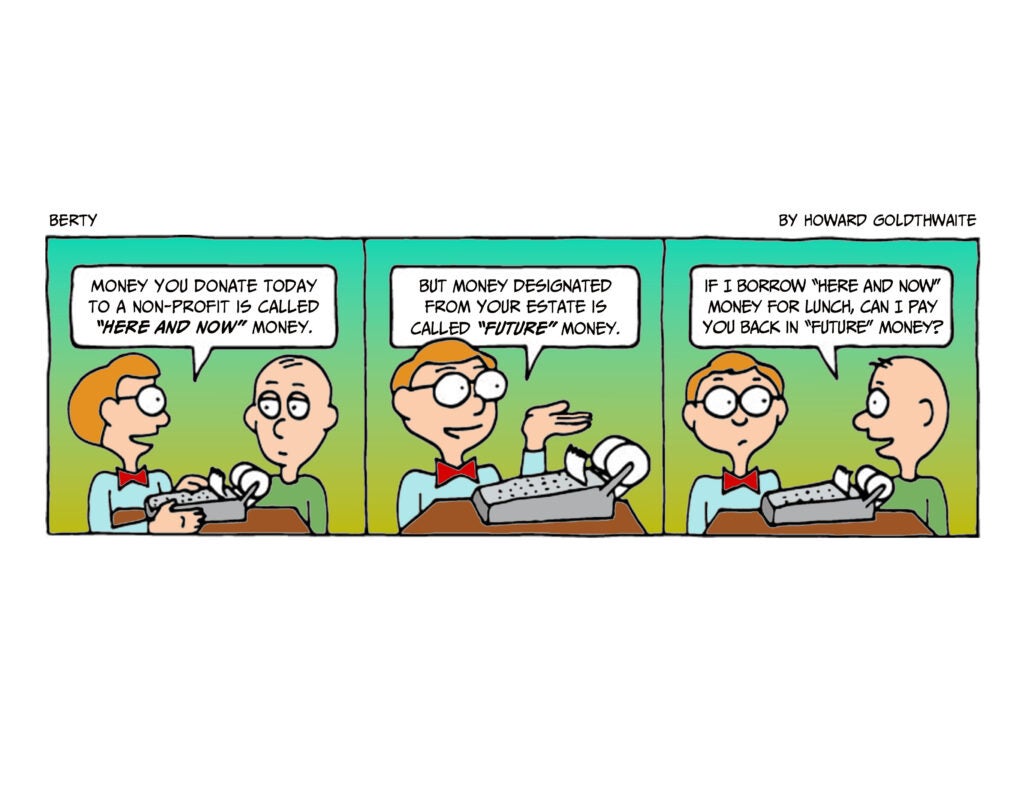

To make the whole subject of how to leave a legacy of religious liberty for your heirs a lot more light-hearted and fun, I asked our own Howard Goldthwaite, a talented creative mind with many years of advertising experience at some of the nation’s premier agencies, to launch a comic strip series to accompany my articles. You know Bill Mauldin won Pulitzers for portraying the harshness of life for combat infantrymen during WW II via his Willie and Joe cartoons, and in so doing, he helped shape the public’s view toward veterans’ issues.

So, here to help us understand wills and estates, we introduce two interesting little characters, Berty and Gerty. In the coming months, these comic figures discuss essential topics in an easily understandable and funny format – and hopefully make them memorable. So, here goes! The inaugural comic strip is here!

Berty, the sensible one, has the first name Lee. Get it? Lee Berty! His pal, a little geeky, is named Gerty – just because it rhymes with? So, in the coming episodes, please enjoy their take on the topic of building a legacy of religious “Lee-Berty” for you and your family.